Texas Child Support Guidelines

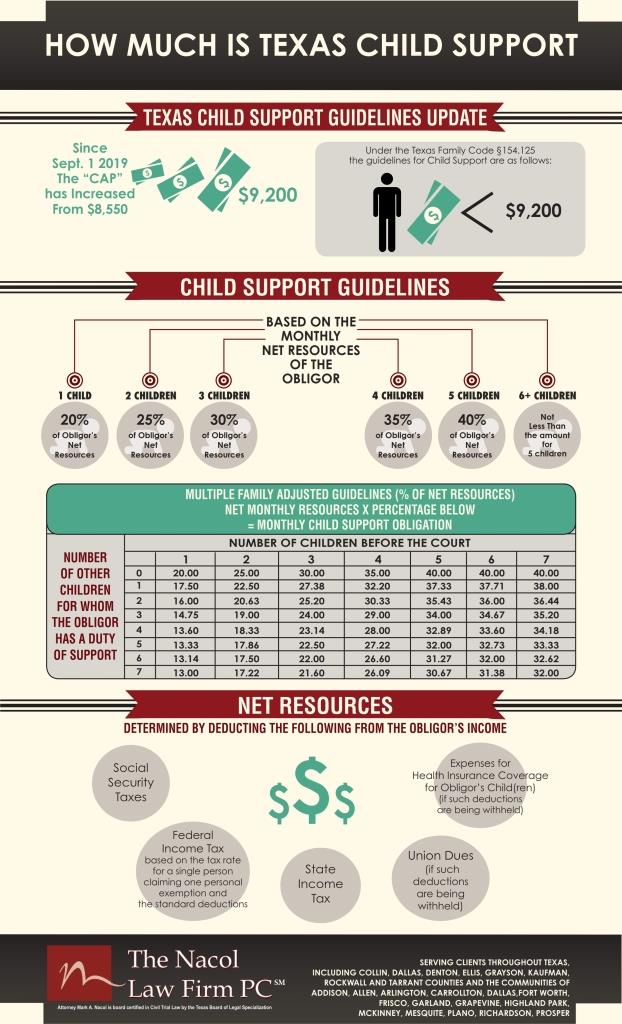

Effective September 1, 2019 The Texas Child Support Division of the Attorney General increased the Maximum child Support under the Texas Child Support Guidelines from $8,550 to the “new cap”of net monthly resources to $9200 annually. This change in the law will increase the amount of maximum child support from of $1,710.00 to $1,840.00 monthly (20% of $9200. For one child)

Texas Family Code §154.125(a)(1) requires that every six years the presumptive amount of net resources to which the child support guidelines apply shall be reviewed and adjusted for inflation by the Texas Office of the Texas Attorney General (OAG). That section sets out the formula for doing so based on the consumer price index. The last adjustment was done in 2013 when the current amount of $8550 per month was established.

How does the “cap” work and what could this mean for you? If your net monthly resources are less than $8,550, the child support obligation will not change on Sept. 1. You are under the “current cap” and lower than the “new cap”. All stays the same.

If you are currently going through litigation and your net monthly resources exceeds $8,550 and the Court orders child support prior to September 1, 2019, Texas Child Support Guidelines will mandate that the Court apply the appropriate child support percentage to the first $8,550 in net monthly resources based on the number of children. But, if the Court orders child support after September 1, 2019, it will apply the new appropriate child support percentage to the first $9,200 in net monthly resources.

Child support under the guidelines is determined by applying the applicable percentage, beginning at 20% for one child and increasing incrementally for each additional child, to the net resources amount. If a child support obligor has monthly net resources over $9200, a party seeking above the guideline’s child support has the burden of proving to the court that additional support should be ordered according to factors set out in Texas Family Code §154.126.

Important to Know: The new “cap” increase of September 1, 2019 will not automatically increase the obligor’s existing child support obligation. Any change in child support standing before September 1, 2019, can only occur through the court with a modification order to increase the child support to the new “Cap” amount of $9200. After September 1, 2019, any new suit for child support will be subject to the new “cap”.

Please review the Texas Office of the Texas Attorney General (OAG) website for a child support calculator for the new breakdown: https://csapps.oag.texas.gov/monthly-child-support-calculator

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite #1190

Dallas, Texas 75231

Nacollawfirm.com

Breaking Up a For Profit Corporation

A For Profit Corporation can be a useful tool if utilized appropriately. One major problem with a For Profit Corporation is the lack of flexibility to dissolve the Corporation when a disagreement arises between the equity shareholders. If ownership in a For Profit Corporation consists of 50% – 50% split in equity then there may be issues down the road.

Many future circumstances may warrant a dissolution of the For Profit Corporation, such as a dispute on the direction of the business, the profitability of the business, or simply a disagreement regarding employment and management duties. When these disputes arise, it may make the For Profit Corporation untenable and impractical. This can be a problem if one owner of the company wishes to continue business as usual and the other owner wishes to dissolve the corporation.

When making the decision to enter into a For Profit Corporation and splitting equity within the Corporation at a 50/50 ratio please keep in mind a couple of things:

- It will be hard to dissolve the Corporation with a 50/50 split in equity;

- It will cost additional expenses to appoint a receiver to manage the company;

- It will cost additional expenses to retain a lawyer for the purpose of forcibly winding down a For Profit Corporation;

- It will be an uphill battle to dissolve a For Profit Corporation that creates jobs in the community because the policy of Texas Courts’ is to find any alternatives to a dissolution that may bring termination to many employees.

- It will be a complex and time consuming undertaking to dissolve a For Profit Corporation if both equity shareholders do not agree.

Prior to forming a For Profit Corporation, you should research all of your options. Many business organization can provide tax relief and flexibility without the rigidity of a For Profit Corporation. Please seek an experienced attorney when creating or amending any business organization and ask the pros and cons of all business entities.

Children Born Outside of Marriage: Unknown Descendants that May Inherit

Creating a Will is extremely important for individuals that have a sizable estate in the Dallas and DFW metroplex. Time and time again, individuals refuse to properly prepare for death and do not see the proper preparation of a legal and valid will as a necessity.

When you refuse to prepare a Will, then your entire estate will pass through the intestate process. Intestate rules apply if: (1) there is no will, (2) the will does not completely dispose of the entire estate, or (3) there is a pretermitted child/adopted child born after the will’s execution.

In certain situations, a child born outside of a marriage may still claim inheritance rights per the rules of Intestate succession. Nonmarital children may establish inheritance rights from the alleged father if the presumption of paternity is proven in court. Paternity is presumed if one of the following elements are met per Tex. Fam. Code § 160.204:

- The child was born during (or within 300 days after) the marriage of the man and the child’s mother;

- During the first two years of the child’s life, the man continuously resided in the same household as the child and represented to others that the child was his; or

- The parties married after the Child’s birth and the man voluntarily asserted his paternity of the child in one of the following ways:

a) The assertion of paternity is in a record filed with the Bureau of Vital Statistics;

b) The man was voluntarily named as the Child’s father on the birth certificate; or

c) The man promised in a record to support the child as his own.In many cases a child that was born out of wedlock may still inherit from the father’s estate if the above mentioned actions can be proved. Depending on the estate, this ability to prove the presumption of paternity can have a great impact on the allocation of the estate’s assets.

Paternity may be rebutted, even if the presumption is proved by a preponderance of evidence, by a DNA test. DNA testing is the only option to rebut the presumption of paternity. Depending on the estate and the desires of all parties involved, a Judge may order that the body be dug up for a DNA sample of the deceased. This is rare, but the Court does have the authority.

It is important to remember that the Statute of Limitations to establish inheritance rights or the presumption of paternity begins at the date in which the father died. The statute of limitations is four years, which means any potential claim must be brought within four years of the individual’s death.

If you are a nonmarital child or born out of wedlock in the DFW area, you may still inherit as a matter of law. A will created prior to the birth of a nonmarital child will not cut off the child from his or her rightful inheritance. For situations like this, please contact Nacol Law Firm to acquire an experienced attorney to navigate through intestacy laws and probate.

Julian Nacol

Dallas Probate Attorney

Nacol Law Firm P.C.

tel: (972) 690-3333

Children Born Outside of Marriage: Unknown Descendants that May Inherit

Creating a Will is extremely important for individuals that have a sizable estate in the Dallas and DFW metroplex. Time and time again, individuals refuse to properly prepare for death and do not see the proper preparation of a legal and valid will as a necessity.

When you refuse to prepare a Will, then your entire estate will pass through the intestate process. Intestate rules apply if: (1) there is no will, (2) the will does not completely dispose of the entire estate, or (3) there is a pretermitted child/adopted child born after the will’s execution.

In certain situations, a child born outside of a marriage may still claim inheritance rights per the rules of Intestate succession. Nonmarital children may establish inheritance rights from the alleged father if the presumption of paternity is proven in court. Paternity is presumed if one of the following elements are met per Tex. Fam. Code § 160.204:

- The child was born during (or within 300 days after) the marriage of the man and the child’s mother;

- During the first two years of the child’s life, the man continuously resided in the same household as the child and represented to others that the child was his; or

- The parties married after the Child’s birth and the man voluntarily asserted his paternity of the child in one of the following ways:

a) The assertion of paternity is in a record filed with the Bureau of Vital Statistics;

b) The man was voluntarily named as the Child’s father on the birth certificate; or

c) The man promised in a record to support the child as his own.In many cases a child that was born out of wedlock may still inherit from the father’s estate if the above mentioned actions can be proved. Depending on the estate, this ability to prove the presumption of paternity can have a great impact on the allocation of the estate’s assets.

Paternity may be rebutted, even if the presumption is proved by a preponderance of evidence, by a DNA test. DNA testing is the only option to rebut the presumption of paternity. Depending on the estate and the desires of all parties involved, a Judge may order that the body be dug up for a DNA sample of the deceased. This is rare, but the Court does have the authority.

It is important to remember that the Statute of Limitations to establish inheritance rights or the presumption of paternity begins at the date in which the father died. The statute of limitations is four years, which means any potential claim must be brought within four years of the individual’s death.

If you are a nonmarital child or born out of wedlock in the DFW area, you may still inherit as a matter of law. A will created prior to the birth of a nonmarital child will not cut off the child from his or her rightful inheritance. For situations like this, please contact Nacol Law Firm to acquire an experienced attorney to navigate through intestacy laws and probate.

Julian Nacol

Dallas Probate Attorney

Nacol Law Firm P.C.

tel: (972) 690-3333

Verbal Contracts and Texas Law

Verbal Contracts do exist and are legally enforceable in Texas, as a matter of law, if they meet necessary legal requirements and specificity. Adequate consideration must be given between the two parties of a verbal contract to make it binding. Adequate consideration is defined in two ways: (1) having a mutual reciprocal exchange [bargained for exchange] or (2) having legal value [an individual must do something that he is not legally obligated to do]. If adequate consideration is given between both parties and all other legal requirements are met, then a verbal contract may be held valid in a court of law.

Verbal contracts are also limited by the Statute of Frauds. The Statute of Frauds requires certain types of contracts to only be in writing purportedly to avoid defrauding citizens.

The following must be in writing:

(1) Making a will or Trust

(2) A contract to answer for the duty of another (Guarantee/Suretyship)

(3) Marriage (exception common law marriage)

(4) Sale and contracts affecting Land

(5) A contract that lasts longer than 1 year from the time it is made and which cannot be performed in one year

(6) Any sale of goods for a price of $500 or more

(7) Sales of securities

Verbal contracts in Texas have limitations. Let’s say that a contractor wanted to paint the outside of your house. You decide to pay the contractor seven thousand to paint the outside of the house and the job will take approximately 3-8 weeks. If you have a verbal contract with the painter and pay him this could be legally enforceable in a court of law. The verbal contract with the painter is not invalidated by any provision set above in the Statute of fraud. It is a contract for service, under one year, and adequate consideration has been given with the payment of seven thousand dollars.

Here is another example of a verbal contract that will not be upheld in a court of law. An individual buys fifty acres from his neighbor for fifty thousand dollars under a verbal contract. Before the fifty thousand dollars is exchanged, the neighbor decides to pull out of the deal. This verbal contract would not be enforceable in court and the buyer cannot enforce the contract because it deals with real estate (land). This is one of the specific types of contracts that must be in writing because of the Statute of Frauds. The individual may get his money back but the point is he cannot enforce the contract since it is not in writing.

The best course of action in the litigious world we live in is to cover your tracks by securing a written contract in almost all circumstances. Do not rely on the limited options that allow a verbal contract to be enforced because in court you will have to deal with the “He said, she said” testimony and incur significant cost of litigation unnecessarily.

NACOL LAW FIRM P.C.

8144 Walnut Hill Lane

Suite 1190

Dallas, Texas 75231

972-690-3333

Office Hours

Monday – Thursday, 8am – 5pm

Friday, 8:30am – 5pm

PRACTICE AREAS

SEARCH

JOIN OUR NETWORK

Attorney Mark A. Nacol is board certified in Civil Trial Law by the Texas Board of Legal Specialization